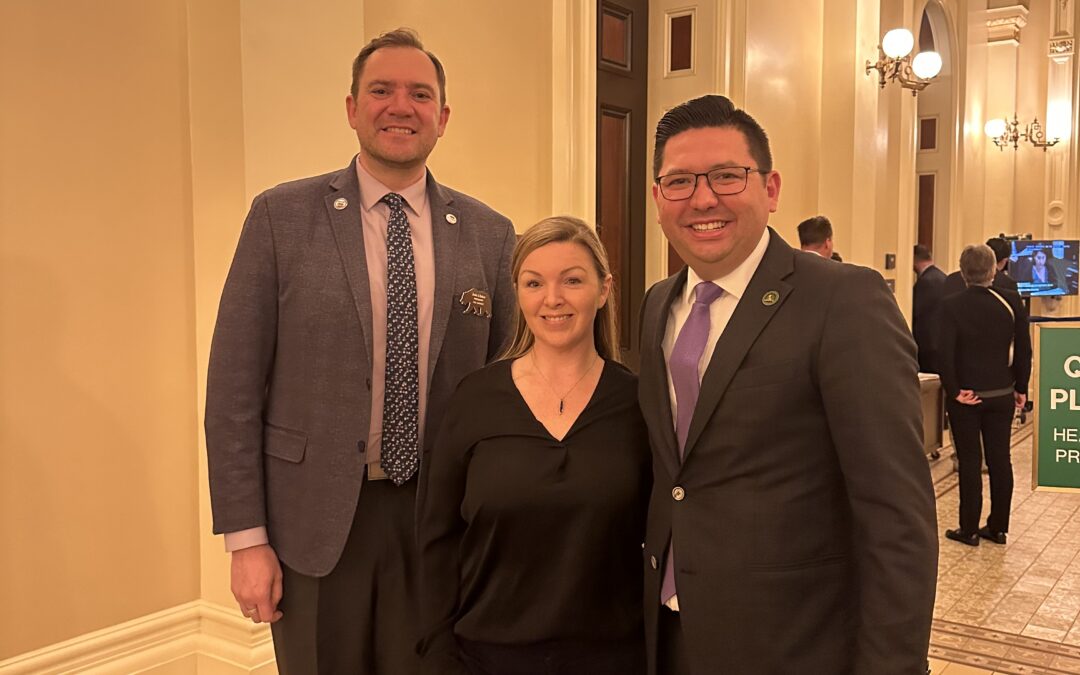

On Monday, April 17, 2023, State President Josh J. Baker gave testimony in support of Assemblymember Josh Hoover’s bill, 7th District, AB 1361 which will, if passed, will allow 100% disabled veterans to be exempt from property tax BEFORE the purchase of a home and not wait for months after the purchase of a home to receive their property taxes back from the state. Under current California Law, 100% VA Disabled Veterans are eligible to apply to their County Tax Assessor’s Office to be exempt from property taxes for the property they own and reside in. Pres. Baker impressed upon the Revenue and Taxation Committee that an overwhelmingly majority of people applying for home loans using this program will be using the VHA Home Loan Program. The VHA Home Loan program has additional fees and expenses and the passage of this bill would help defray the costs of the fees. He also advised the Committee that a majority of the 100% Disabled Veterans Pres. Baker contacted, they were unaware of the current Property Tax Exemption entitlements and there needs to a better way to communicate with 100% disabled veterans on the many entitlements the State of California provides them. Pres. Baker was joined by Platinum CAL-EANGUS Sponsor Lindsay McCoy with CARE Finance Group to be the expert witnesses during the bill’s hearing. Lindsay advised the Committee on the current process of how County Tax Assessors appraise properties at the time of the sale and how the bill, if passed, can be amended to benefit Veterans applying for the program. The Taxation and Revenue Committee, Chaired by Jacqui Irwin, unanimously voted to pass the bill to the next committee. The bill was referred to the Committee on Appropriations.